October 9, 2025

Hosted at WEC Energy Group

About +Venture North

Presented by NVNG Investment Advisors, +Venture North 2025 will showcase how collaboration and networks between venture capital and corporations can further propel Midwestern industries to become engines of economic growth.

This year’s program will explore the breakthroughs reshaping critical sectors—from autonomous machines and robotics in heavy equipment to the future of transportation and mobility. We’ll examine how national security is driving a new wave of defense tech, how quantum and advanced computing are unlocking next-gen capabilities, and how reindustrialization is redefining construction, energy, and logistics across our region.

Attendees will hear insights from venture capitalists, corporate innovators, successful founders, and operators leading the charge.

Additional events from NVNG this week include:

Wednesday 10/8 @ 2 pm

NVNG’s Corporate-Ready Day: For Wisconsin and visiting corporations to learn more about one another, and to engage with venture-backed startups and globally-focused venture capitalists aligned with the Midwest region’s core industries. Milwaukee – Pilot Project. To inquire about attending, please reach out to Marina Rostein.

Wednesday 10/8 @ 5 pm

NVNG’s Community Happy Hour: Our annual happy hour will take place on October 8, kicking off +Venture North. Join us if you’re in town! Milwaukee – Pilot Project. Registration here.

Thursday 10/9 @ 6 pm

NVNG Annual Meeting Reception: This event is for our +Venture North speakers, NVNG LPs, NVNG’s portfolio venture funds, and select guests. This will take place following +Venture North. Milwaukee – invite only. To inquire about attending, please reach out to Marina Rostein.

Friday 10/10 @ 8:30 am

NVNG Annual Meeting:This year’s annual meeting will take place the morning following +Venture North. NVNG’s investors, portfolio venture capital fund managers, select guests, and those interested in learning more about NVNG investments. Milwaukee – RW Baird. Registration Here.

Keynote

Stefano Daza Arango

Manager of Conservation Partnerships at Colossal Foundation

Marshall Sandman

Managing Partner at Animal Capital

Vijen Patel

Founding Partner at The 81 Collection

Featured Sessions

Welcome & Opening Remarks

Grady Buchanan

Managing Director at NVNG Investment Advisors

Scott Lauber

President & CEO at WEC Energy Group

Mike Hooper

EVP & COO at WEC Energy Group

Power Shift: From Risk to Reality – Nuclear’s Moment

As global energy demand surges and pressure mounts for cleaner, more reliable power, nuclear energy is re-entering the spotlight. This session will bring together voices from industry and venture capital-including leaders from WEC Energy Group, Khosla Ventures, The Nuclear Company, and Husch Blackwell-to explore why this “nuclear renaissance” feels different. From breakthroughs in fusion and SMRs to investment shifts and policy momentum, the discussion will tackle what’s truly driving this moment-and what must happen next to seize it. Expect candid insights on deployment hurdles, risk vs. return in nuclear ventures, and why places like Wisconsin are leaning in.

John Myer

Senior Counsel at Husch Blackwell

Alice Brooks

Partner at Khosla Ventures

Kyle Hoops

Vice President at WEC Energy Group

Hunter Patton

Vice President, Finance & Treasurer at The Nuclear Company

Founders on the Front Line: Scaling in the New Defense Economy

As defense tech accelerates into a new era of innovation, this panel with four cutting-edge CEOs, from precision manufacturing to aerospace propulsion, will explore what it really takes to build in this space. From navigating DoD corridors and congressional cycles to overcoming sourcing challenges and capital hurdles, our panelists will share lessons from the front lines. With the defense sector expanding beyond legacy systems into advanced materials, software, and AI-enabled hardware, the stakes are rising-and so is the noise. Attendees will walk away with insight into where the real opportunities lie, how to separate hype from substance, and what makes a state like Wisconsin and the broader Midwest increasingly attractive for defense innovation.

Bill Berrien

CEO at Pindel Global Precision

George Liddell

Senior Director of Operations at Firehawk Aerospace

Dhruva Rajendra

CEO at Deterrence

Naweed Thamas

CEO at Aeon Industrial

Building Bridges: How Startups & Corporates can Partner Smarter

In this breakout session, Vocap Partners’ Emery Waddell and Georgia-Pacific’s Mike Slawson will dive into what it really takes for corporates to engage effectively with startups. From defining innovation challenges to sourcing external partners and building internal buy-in, this conversation will unpack the cultural and structural shifts needed to make collaboration work. With real-world examples and practical advice, they’ll explore how to navigate organizational roadblocks, measure impact, and become a signal-rich, trustworthy player in the venture ecosystem. Ideal for corporates looking to sharpen their innovation strategies-and for the firms investing into startups aiming to partner with them.

Mike Slawson

Director at Georgia-Pacific Ventures

Emery Waddell

General Partner at Vocap Partners

The Data Center Boom: Digital Infrastructure Meets the Heartland

As AI and cloud computing continue to drive explosive growth in digital infrastructure, data centers are becoming critical economic engines—especially in emerging regions like Wisconsin. This session will bring together leaders from Generac, EnCharge AI, and Cloverleaf Infrastructure to explore how AI is reshaping the data center landscape, what it means for power grids and sustainability, and why the Midwest is now a strategic hub for innovation. Moderated by Timescale Ventures’ Carly Anderson, the panel will unpack the real-world challenges and opportunities facing startups, corporates, and investors in the next era of compute.

Carly Anderson

Co-Founder & Managing Partner at Timescale Ventures

Aaron Bilyeu

Chief Development Officer at Cloverleaf Infrastructure

Shwetank Kumar

Chief Scientist at EnCharge AI

Ricardo Navarro

Senior Vice President & General Manager – Global Telecom & Data Centers at Generac Power Systems

The Road Ahead: Freight, Fleet, & Backing what Moves

From autonomy and electrification to freight logistics, investors and innovators navigating the evolving transportation landscape will lead us through what the future of transportation holds. Leaders from GM Ventures, Fontinalis Partners, New Industry VC, and Evans Transportation will share hard-won insights on where capital is flowing, what tech is overhyped, and how real-world constraints-like labor, infrastructure, and freight specialization-shape adoption across sectors. Hear open discussion around the myths of autonomous ubiquity, the realities of scaling in a fragmented industry, and the signals that matter most when backing mobility startups. Whether you’re tracking emerging trends or seeking your next strategic move, this is where insight meets momentum.

Alex Roy

General Partner & Co-Founder at New Industry VC

Stefon Crawford

Partner at GM Ventures

James Schlosser

SVP Innovation at Evans Transportation

Chris Stallman

Managing Partner at Fontinalis Partners

Sink or Scale: The State of Marine Innovation

In this back-and-forth conversation, two founders shaping the future of marine and mobility tech explore what’s changing, and what still needs to. From controls and automation to domestic manufacturing, Patrick Nanson (Maritime Operations Group) and Trent Warnke (Flamingo Electric) will discuss the challenges of sourcing, scaling, and innovating in sectors that often get overlooked. Expect honest takes on the gaps in marine defense, the “why now” for building in Wisconsin, and how to navigate workforce, autonomy, and investor expectations in water-based industries. A tactical, inside look at a category on the edge of transformation.

Trent Warnke

Chief Strategy Officer at Flamingo Marine

Parker Stratton

Co-Founder & President at Maritime Operations Group

Industrial Intelligence: Robotics & Heavy Equipment

Welding together venture capital, entrepreneurial ingenuity, and industrial execution, this session will examine how robotics and automation are tangibly transforming heavy equipment and engineering operations. From accelerated AI-driven path planning to enhancing legacy heavy machinery with intelligent systems, they unpack what’s real versus hype when it comes to robotics in industrial environments. Attendees will gain insight into the shifting capital landscape, the evolving role of humans in automation workflows, and how collaborative innovation is shaping enterprise-scale robotics adoption.

Zack Birky

Senior Investment Manager at Caterpillar Ventures

Erik Nieves

Founder & CEO at Plus One Robotics

Chris Prazak

Vice President Sales & Marketing, North America at Yaskawa Motoman Robotics

Mike Rikkola

Senior Director, Automation Center of Excellence at Komatsu

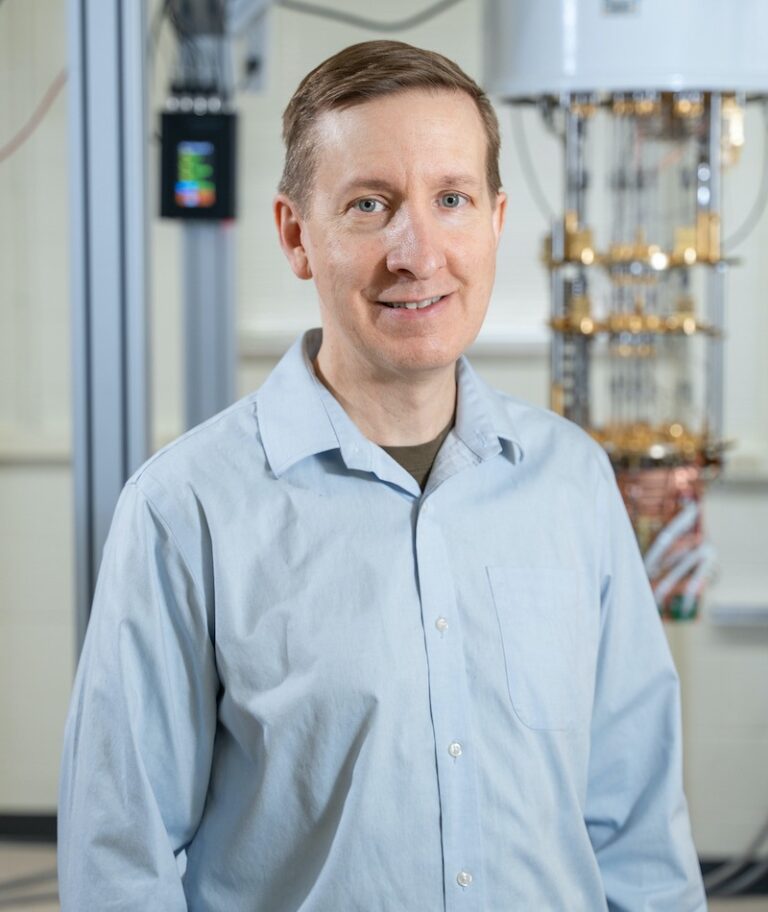

The Quantum Leap: Scaling Science into Industry

Quantum technology is moving from theoretical to tangible. Join operators and investors from the Chicago Quantum Exchange, UW-Madison, Infleqtion, and Airbus Ventures in exploring the breakthroughs, barriers, and bold bets shaping the quantum landscape today. From superconducting qubits to quantum sensing, national security to workforce needs, the conversation will span scientific innovation, commercialization, and regional momentum-especially across Wisconsin and the Midwest. Whether you’re quantum-curious or already building in the space, this session will dive into real use cases, capital flows, and the critical infrastructure needed to scale.

Kate Waimey Timmerman

CEO at Chicago Quantum Exchange

Nicole Conner

Partner at Airbus Ventures

Britton Plourde

Quantum Hardware Engineer at Qolab

Martin Lichtman

Senior Quantum Physicist at Infleqtion

Keynote: A New Dawn of Wild: De-extinction and the Future of Conservation

Colossal Biosciences is on a mission to Make Extinction a Thing of the Past. The company that successfully brought the dire wolf back from extinction is also saving today’s most imperiled creatures. Colossal’s Stefano Daza Arango will unveil how the company is deploying frontier biotechnologies to a global network of partners and reshaping the conservation landscape along the way. Following his presentation, he’ll be joined in conversation by investors Marshall Sandman of Animal Capital and Vijen Patel of 81 Collection to explore the real commercial potential — and ethical complexity — of building a for-profit model for saving species. A rare, behind-the-scenes look at where frontier science meets venture capital, and what it will take to fund a future worth inheriting.

Stefano Daza Arango

Manager of Conservation Partnerships at Colossal Foundation

Marshall Sandman

Managing Partner at Animal Capital

Vijen Patel

Founding Partner at The 81 Collection

Made in the Future: Reindustrialization Across the U.S.

Reindustrialization isn’t about going backward-it’s about rethinking how and where we build. Hear from Grid Capital, Pax Ventures, Rivian, and Karman Industries as they explore what modern American manufacturing really looks like, from EV production to Factory 4.0 and onshoring strategies. With a focus on talent, grid infrastructure, and the evolving role of tech in industrial growth, the discussion will offer actionable insights for corporates, founders, and investors alike. Assume a grounded take on how regions like the Midwest can lead this next wave-not by copying another’s playbook, but by building something better.

Jackie DiMonte

Co-Founder & General Partner at Grid Capital

Tom Solomon

VP Business Development at Rivian

David Tearse

Co-Founder & CEO at Karman Industries

Michelle Volz

Founder and Managing Partner at Pax VC

The Future of Longevity: Innovation, Policy, and the Path to a Healthier Future

As advancements in biotechnology, AI, and preventative health converge, the future of human longevity is being rewritten. This dynamic panel, kicking off with a short presentation by Dylan Livingston, CEO of the Alliance for Longevity Initiatives, will bring together leaders from venture capital, government advocacy, and very deep-tech innovation to explore what it will take to radically extend both healthspan and lifespan. From groundbreaking biosensors and real-time biomarkers to federal policy shifts and investment trends, panelists will discuss the emerging pillars of longevity and how we bring them from lab to life. Expect a lively, human-centered conversation that touches on the scientific, economic, and personal stakes of living longer and better.

Dylan Livingston

Founder & CEO at The Alliance for Longevity Initiatives

Tristan Hunt

Partner at Averin

Cheryl Sew Hoy

Founder & CEO at Tiny Health

Rich Yang

CEO at Biolinq

AI at Work: Why Most Projects Fail and What Actually Works

This breakout will feature a candid, fast-paced fireside chat exploring what’s actually working in AI today — and what isn’t. From why so many enterprise AI implementations fail to the real tools and tactics early-stage companies are using to succeed, this session offers practical insight for corporates and investors alike. Expect real-world examples, a few technical deep dives, and plenty of back-and-forth on what defines an “AI company” in 2025. Whether you’re looking to invest in or deploy AI at the corporate level, this is the tactical download you don’t want to miss.

Elizabeth Cook

Managing Partner at AI Capital

Eli Blee-Goldman

Co-Founder & General Partner at Character Capital

Blueprint to Breakthrough: The Future of Construction

In an industry facing labor shortages, tight margins, and rising project complexity, construction is turning to technology for solutions, but adoption is anything but simple. Hear from venture, corporate innovation, and the field to explore what’s working today, where the frictions lie, and what the next 5-10 years could look like. From robotics and prefab to AI-powered project management, we’ll dive into the realities of scaling tech in a notoriously risk-averse industry. Whether you’re a builder or an investor, this session will offer real-world insight into where construction tech is headed-and what it takes to succeed.

Gregg Wallace

General Partner at Nirman Ventures

Charlie Haas

Director of Preconstruction at CG Schmidt

Colleen Konetzke

Chief of Staff at Document Crunch

Akihiro Manda

Technology Development Manager at Kajima

Beyond Launch: Investing in the New Space Economy

The commercial space economy is accelerating — and it’s no longer just about rockets and satellites. From orbital manufacturing and Earth observation to climate resilience and global broadband, space is now a cross-sector frontier. Join leaders from Boeing Ventures, Lockheed Martin Ventures, In-Q-Tel, and Balerion Space Ventures as they unpack how corporates and investors are backing this next wave of dual-use innovation. This session explores what makes space companies fundable today, the realities of scaling capital-intensive ventures, and why the Midwest’s deep manufacturing and defense roots may be key to shaping the sector’s future.

Gareth Keane

Partner at IQT

Ali Perez, PhD

Senior Investment Manager & Portfolio Manager at Lockheed Martin Ventures

Aaron Peterman

Managing Director at Boeing Ventures

Venture as a Tool: How Corporates are Underwriting Innovation

Corporate venture capital isn’t one-size-fits-all. From managing strategic portfolios to enabling M&A and driving new distribution opportunities, different corporates bring different mandates — especially in industries like insurance, where innovation is both necessary and nuanced. In this session, Rich Scudellari of Penny Jar Capital will moderate a conversation on how American Family and M3 Insurance engage with startups, why their models differ, and what other corporations can learn about building internal innovation engines. With the Midwest’s legacy industries at an inflection point, this panel offers a pragmatic look at how corporate innovation and venture can be used as a tool — not just a trend.

CJ Armbrust

Principal at American Family Ventures

Rebecca Menefee

Vice President at M3 Insurance

Rich Scudellari

Founding Partner at Penny Jar Capital

Builders Showcase

Join us for a high-energy closing session spotlighting ten dynamic startup leaders driving innovation across healthcare, logistics, climate tech, AI, and enterprise software. In this rapid-fire panel, founders will share real stories of working with corporate partners, breaking into tough markets, and scaling with limited resources. From biotech breakthroughs to last-mile logistics, from financial tools for healthcare to carbon capture tech — each speaker brings a unique perspective on building with purpose and partnering for impact. Presented by the Wisconsin Economic Development Corporation; moderated by the Milwaukee Tech Hub.

Shayna Hetzel

Vice President, Entrepreneurship & Innovation at Wisconsin Economic Development Corporation

Joe Poeschl

Executive Director at MKE Tech Hub Coalition

Nick Anastasiades

Co-Founder & CEO at Benji

Bill Catania

CEO & Founder at OneRail

Tom Dean

Founder & CEO at Renaissant

Anita Hossain Choudhry

Co-Founder & CEO at The Grand

Matt (MJ) Johnson

CEO & Co-Founder at Blank Metal

Francisco Martin-Rayo

CEO & Co-Founder at Helios AI

Matthew Pearlson

CEO at Intrnls, Inc.

Saira Ramasastry

Co-Founder & COO at Sanacor

Nathan Rollings

Field CISO at Zafran

Ryan Wheeler

CEO at Cylerity

Closing Remarks

Grady Buchanan

Managing Director at NVNG Investment Advisors

Carrie Thome

Managing Director at NVNG Investment Advisors

Marina Rostein

Head of Platform at NVNG Investment Advisors

Reception

Join us in one of WEC Energy Group’s iconic spaces for networking, light appetizers, and drinks in a classic Milwaukee setting!

Uniquely Wisconsin

Get a taste of Wisconsin’s sweet side with HARIBO of America, the makers of the original gummy bear. You’ll hear how HARIBO’s story blends global fun with a local footprint that’s uniquely ours.

Rick LaBerge

Chief Commercial Officer at HARIBO

Session Speakers

Aaron Bilyeu

Chief Development Officer at Cloverleaf Infrastructure

Aaron Peterman

Managing Director at Boeing Ventures

Akihiro Manda

Technology Development Manager at Kajima

Alex Roy

General Partner & Co-Founder at New Industry VC

Ali Perez, PhD

Senior Investment Manager & Portfolio Manager at Lockheed Martin Ventures

Alice Brooks

Partner at Khosla Ventures

Anita Hossain Choudhry

Co-Founder & CEO at The Grand

Bill Berrien

CEO at Pindel Global Precision

Bill Catania

CEO & Founder at OneRail

Britton Plourde

Quantum Hardware Engineer at Qolab

CJ Armbrust

Principal at American Family Ventures

Carly Anderson

Co-Founder & Managing Partner at Timescale Ventures

Charlie Haas

Director of Preconstruction at CG Schmidt

Cheryl Sew Hoy

Founder & CEO at Tiny Health

Chris Prazak

Vice President Sales & Marketing, North America at Yaskawa Motoman Robotics

Chris Stallman

Managing Partner at Fontinalis Partners

Colleen Konetzke

Chief of Staff at Document Crunch

David Tearse

Co-Founder & CEO at Karman Industries

Dhruva Rajendra

CEO at Deterrence

Dylan Livingston

Founder & CEO at The Alliance for Longevity Initiatives

Eli Blee-Goldman

Co-Founder & General Partner at Character Capital

Elizabeth Cook

Managing Partner at AI Capital

Emery Waddell

General Partner at Vocap Partners

Erik Nieves

Founder & CEO at Plus One Robotics

Francisco Martin-Rayo

CEO & Co-Founder at Helios AI

Gareth Keane

Partner at IQT

George Liddell

Senior Director of Operations at Firehawk Aerospace

Gregg Wallace

General Partner at Nirman Ventures

Hunter Patton

Vice President, Finance & Treasurer at The Nuclear Company

Jackie DiMonte

Co-Founder & General Partner at Grid Capital

James Schlosser

SVP Innovation at Evans Transportation

Joe Poeschl

Executive Director at MKE Tech Hub Coalition

John Myer

Senior Counsel at Husch Blackwell

Kate Waimey Timmerman

CEO at Chicago Quantum Exchange

Kyle Hoops

Vice President at WEC Energy Group

Marshall Sandman

Managing Partner at Animal Capital

Martin Lichtman

Senior Quantum Physicist at Infleqtion

Matt (MJ) Johnson

CEO & Co-Founder at Blank Metal

Matthew Pearlson

CEO at Intrnls, Inc.

Michelle Volz

Founder and Managing Partner at Pax VC

Mike Hooper

EVP & COO at WEC Energy Group

Mike Rikkola

Senior Director, Automation Center of Excellence at Komatsu

Mike Slawson

Director at Georgia-Pacific Ventures

Nathan Rollings

Field CISO at Zafran

Naweed Thamas

CEO at Aeon Industrial

Nick Anastasiades

Co-Founder & CEO at Benji

Nicole Conner

Partner at Airbus Ventures

Parker Stratton

Co-Founder & President at Maritime Operations Group

Rebecca Menefee

Vice President at M3 Insurance

Ricardo Navarro

Senior Vice President & General Manager – Global Telecom & Data Centers at Generac Power Systems

Rich Scudellari

Founding Partner at Penny Jar Capital

Rich Yang

CEO at Biolinq

Rick LaBerge

Chief Commercial Officer at HARIBO

Ryan Wheeler

CEO at Cylerity

Saira Ramasastry

Co-Founder & COO at Sanacor

Scott Lauber

President & CEO at WEC Energy Group

Shayna Hetzel

Vice President, Entrepreneurship & Innovation at Wisconsin Economic Development Corporation

Shwetank Kumar

Chief Scientist at EnCharge AI

Stefano Daza Arango

Manager of Conservation Partnerships at Colossal Foundation

Stefon Crawford

Partner at GM Ventures

Tom Dean

Founder & CEO at Renaissant

Tom Solomon

VP Business Development at Rivian

Trent Warnke

Chief Strategy Officer at Flamingo Marine

Tristan Hunt

Partner at Averin

Vijen Patel

Founding Partner at The 81 Collection

Zack Birky

Senior Investment Manager at Caterpillar Ventures

FAQs

Do I need to register to attend +Venture North?

Yes, as all guests need to be pre-registered and approved by our venue, we do not recommend booking travel before you’re invited to formally register. We encourage you to join us at the NVNG Community Happy Hour on October 8. Please register for that event here: https://founderhappyhour2025.rsvpify.com/

Will a hotel block be available?

A room block is available at the Courtyard Milwaukee Downtown, conveniently located right across from WEC Energy Group. Please note that the room block will close on September 8, 2025. After this date, we cannot guarantee the availability of rooms or the pricing of $169 per night.

To make an online reservation, please use the following link.

If you would like to contact the hotel directly, please reference the group code (NVN) or mention the NVNG Investment Advisors group block to secure the group rate.

Will parking be available?

Paid public parking is available at the Milwaukee Grand Ave Garage, 615 North 2nd Street, Milwaukee, WI.

Will food be served?

A light breakfast and lunch will be provided, and snacks, coffee, and water will be available throughout the day. Please remember to stay for the reception immediately following +Venture North, where appetizers and beverages will be served.